The recent US stock market plunge has sent shockwaves through investors and financial markets worldwide. With a myriad of factors contributing to the downturn, it's crucial to understand the root causes and implications for the future. In this article, we delve into the key factors behind the recent stock market plunge and analyze its potential impact on the economy.

Historical Context

To grasp the current situation, it's essential to consider the historical context. Over the past few years, the US stock market has experienced significant growth, with indices like the S&P 500 reaching record highs. However, this period of growth has been characterized by high valuations and increased volatility.

Factors Contributing to the Plunge

Several factors have contributed to the recent stock market plunge:

Economic Concerns: Rising inflation, supply chain disruptions, and the ongoing COVID-19 pandemic have created uncertainty in the market, leading to a decline in investor confidence.

Interest Rate Hikes: The Federal Reserve's decision to raise interest rates has impacted the stock market, as higher rates make borrowing more expensive and can dampen consumer spending.

Tech Stocks: The tech sector, which has been a significant driver of the market's growth, has experienced a particularly sharp decline. This can be attributed to increased regulatory scrutiny and concerns about overvaluation.

Corporation Earnings: Many companies have reported lower-than-expected earnings, further contributing to the stock market plunge.

Impact on the Economy

The recent stock market plunge has several potential implications for the economy:

Consumer Confidence: A declining stock market can lead to reduced consumer confidence, which may result in lower spending and economic growth.

Business Investment: Companies may become more cautious about investing in new projects or expanding their operations, which can further slow economic growth.

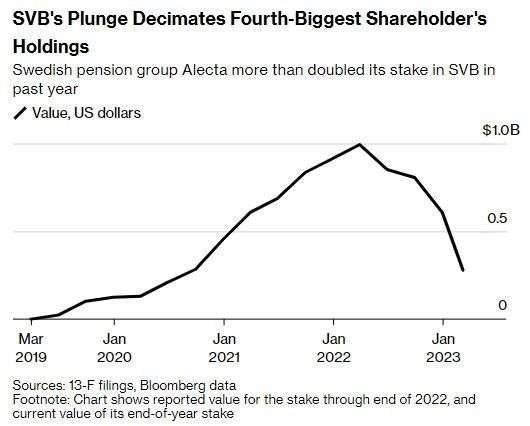

Retirement Savings: Many Americans rely on their retirement savings, such as 401(k) plans, for their financial security. A stock market plunge can significantly impact these savings.

Case Study: The 2020 Market Crash

The 2020 stock market plunge provides a relevant case study for understanding the recent downturn. The COVID-19 pandemic led to widespread economic shutdowns and uncertainty, causing the stock market to plummet. However, the market eventually recovered, with indices like the S&P 500 reaching new highs. This highlights the potential for market volatility and the importance of long-term investing strategies.

Conclusion

The recent US stock market plunge is a complex issue with multiple contributing factors. While the downturn may cause short-term concerns, it's crucial to consider the long-term implications and invest strategically. By understanding the root causes of the downturn and the potential impact on the economy, investors can make informed decisions and navigate the turbulent market landscape.

Understanding the US Stock Exchange Market:? can foreigners buy us stocks