In today's globalized world, the stock markets of the United States and China play a significant role in the global financial landscape. This article provides a comprehensive comparison of the two markets, highlighting their unique features, performance, and future prospects.

Market Size and Composition

The U.S. stock market is the largest and most developed in the world, with a market capitalization of over $40 trillion. It is home to numerous multinational corporations, tech giants, and innovative startups. The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are some of the most well-known indices representing the U.S. stock market.

In contrast, the Chinese stock market has seen rapid growth in recent years, with a market capitalization of around $11 trillion. It is dominated by state-owned enterprises and offers exposure to the world's second-largest economy. The Shanghai Stock Exchange Composite Index and Shenzhen Stock Exchange Composite Index are the primary indices representing the Chinese market.

Performance

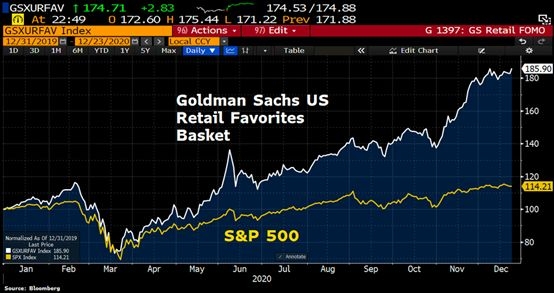

The performance of both markets has been influenced by various factors, including economic conditions, geopolitical tensions, and regulatory changes. Over the past decade, the U.S. stock market has outperformed the Chinese market, with the S&P 500 delivering an annual return of around 10%. However, the Chinese market has shown strong growth potential, particularly in sectors like technology, healthcare, and consumer discretionary.

Sector Analysis

Technology: The U.S. tech sector, represented by the NASDAQ Composite, has been a significant driver of market growth. Companies like Apple, Microsoft, and Amazon have contributed to the strong performance of the U.S. market. In contrast, the Chinese tech sector, represented by the CSI 300, has seen rapid growth, with companies like Tencent and Alibaba leading the way.

Healthcare: The healthcare sector in both markets has been a key performer, driven by increasing demand for medical services and advancements in technology. Companies like Johnson & Johnson and Pfizer in the U.S. and China Resources Pharmaceutical Group in China have contributed to the sector's growth.

Consumer Discretionary: The consumer discretionary sector has also been a significant performer in both markets, driven by rising consumer spending and increased disposable income. Companies like Disney and Home Depot in the U.S. and Tencent and Alibaba in China have been key contributors to this sector's growth.

Geopolitical Factors

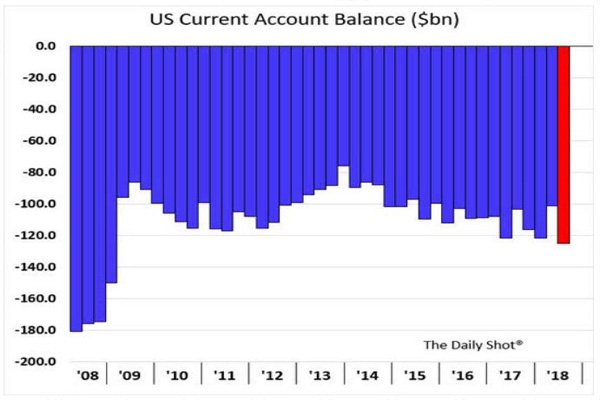

Geopolitical tensions between the U.S. and China have had a significant impact on the stock markets of both countries. Trade disputes, technology restrictions, and diplomatic tensions have caused volatility in the markets. However, despite these challenges, both markets have shown resilience and adaptability.

Future Prospects

The future prospects for both the U.S. and Chinese stock markets remain promising. The U.S. market is expected to continue its growth trajectory, driven by innovation, technological advancements, and a strong economic foundation. The Chinese market, on the other hand, is expected to see significant growth, particularly in sectors like technology, healthcare, and consumer discretionary.

In conclusion, the U.S. and Chinese stock markets offer unique opportunities and challenges. Investors should carefully analyze both markets and consider their individual risk tolerance and investment goals before making investment decisions.

Title: US-Japan Trade Deal: A Boon for the ? can foreigners buy us stocks