The introduction of tariffs has long been a contentious issue in global trade, and its impact on the stock market is a topic of significant interest. In this article, we delve into the effects of tariffs on the stock market, examining both the immediate aftermath and the subsequent recovery. By analyzing key sectors and market trends, we aim to provide a comprehensive understanding of how tariffs have influenced the stock market landscape.

Immediate Impact of Tariffs on the Stock Market

When tariffs are imposed, they often lead to increased costs for businesses, which can directly affect their profitability. This, in turn, can lead to a decline in stock prices. The initial impact of tariffs on the stock market is often negative, as investors react to the uncertainty and potential for higher prices.

For instance, the imposition of tariffs on steel and aluminum imports by the United States in 2018 had a significant impact on the stock market. The Dow Jones Industrial Average fell by over 600 points in the days following the announcement, reflecting investor concerns about the potential for broader trade disputes and increased costs for businesses.

Long-Term Effects and Recovery

While the immediate impact of tariffs on the stock market can be negative, the long-term effects can vary. In some cases, companies may be able to adapt to the new trade environment, leading to a recovery in stock prices. This is particularly true for companies that have the ability to pass on increased costs to consumers or that can find alternative suppliers.

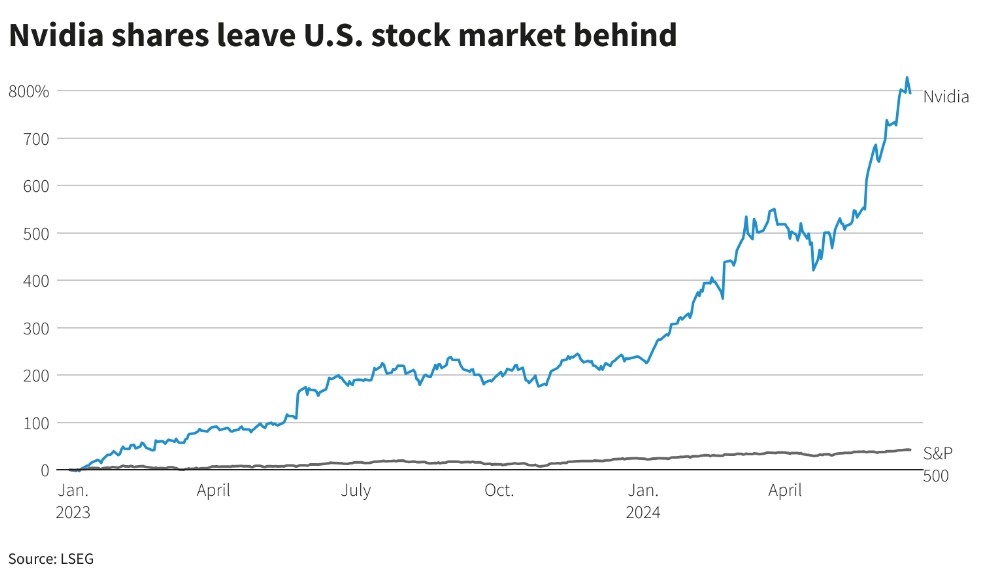

One example of this is the technology sector, which has largely been resilient in the face of tariffs. Companies like Apple and Microsoft have been able to absorb increased costs and maintain strong financial performance, leading to steady growth in stock prices.

Sector-Specific Impacts

The impact of tariffs on the stock market can vary significantly by sector. Industries that are heavily reliant on international trade, such as manufacturing and agriculture, are often more sensitive to changes in trade policies. In contrast, sectors like technology and consumer discretionary may be less affected by tariffs.

For example, the agricultural sector has faced significant challenges due to tariffs imposed by the United States on China. This has led to a decline in stock prices for companies like John Deere and Caterpillar, which rely on exports to China.

Conclusion

The stock market's response to tariffs is complex and multifaceted. While the immediate impact of tariffs can be negative, the long-term effects can vary significantly by sector and company. By understanding these dynamics, investors can better navigate the stock market in the face of changing trade policies.

Decoding the Annual US Stock Market Returns? can foreigners buy us stocks