Are you a Canadian investor looking to diversify your portfolio? Have you been contemplating whether to invest in US stocks? If so, you're not alone. Many Canadians are interested in investing across the border, but it's important to understand the risks and rewards involved. In this article, we'll explore the pros and cons of investing in US stocks for Canadian investors.

Understanding the US Stock Market

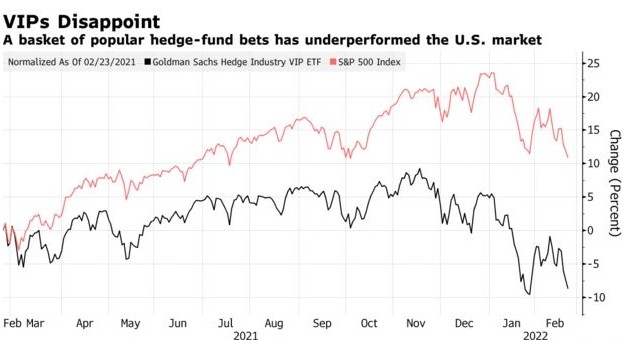

The US stock market is one of the largest and most liquid in the world. It offers a wide range of investment opportunities, from large-cap companies like Apple and Microsoft to small-cap startups with high growth potential. The S&P 500, the most widely followed index, represents the top 500 companies in the United States and is often used as a benchmark for the overall market.

Pros of Investing in US Stocks

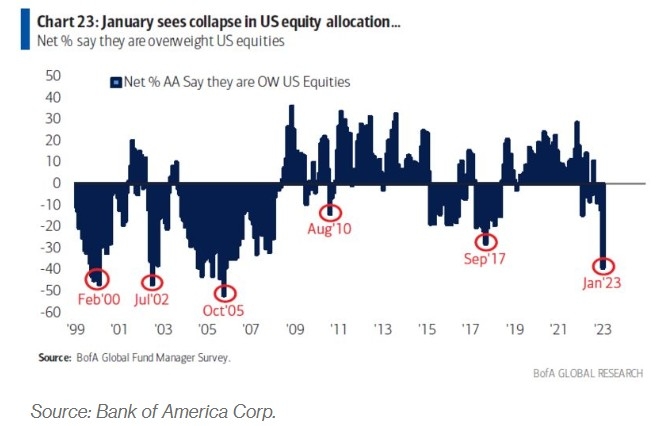

- Diversification: Investing in US stocks can help diversify your portfolio, reducing your exposure to the Canadian market's volatility.

- Access to Top Companies: The US stock market offers access to some of the world's most successful and innovative companies.

- Currency Conversion: If the Canadian dollar strengthens against the US dollar, your returns in Canadian dollars could increase.

- Potential for Higher Returns: Historically, the US stock market has offered higher returns than the Canadian market.

Cons of Investing in US Stocks

- Currency Risk: If the Canadian dollar weakens, your returns in Canadian dollars could decrease.

- Tax Implications: Canadian investors must pay taxes on dividends received from US stocks, which can be a significant cost.

- Regulatory Differences: The US market has different regulations and reporting requirements compared to Canada, which can be challenging for Canadian investors.

How to Invest in US Stocks

If you decide to invest in US stocks, there are several options available:

- Brokerage Accounts: You can open a brokerage account with a Canadian or US-based brokerage firm to buy and sell US stocks.

- ETFs: Exchange-traded funds (ETFs) that track US stock indices or specific sectors can be a convenient way to invest in US stocks.

- Mutual Funds: Some Canadian mutual funds invest in US stocks, allowing you to gain exposure to the US market through a diversified portfolio.

Case Study: Investing in US Stocks

Let's consider a hypothetical scenario. Imagine a Canadian investor named Sarah who decides to invest $10,000 in US stocks. She chooses a mix of large-cap companies like Apple, Microsoft, and Amazon, as well as some small-cap startups with high growth potential.

Over the next five years, the US stock market performs well, and Sarah's investments grow to $15,000. However, during this period, the Canadian dollar weakens against the US dollar, causing her returns to be worth more in Canadian dollars.

Conclusion

Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. While there are risks involved, the potential for higher returns and access to top companies make it an attractive option. Before making any investment decisions, it's important to carefully consider your financial goals, risk tolerance, and tax implications.

How to Open a Stock Account in the US: A St? can foreigners buy us stocks