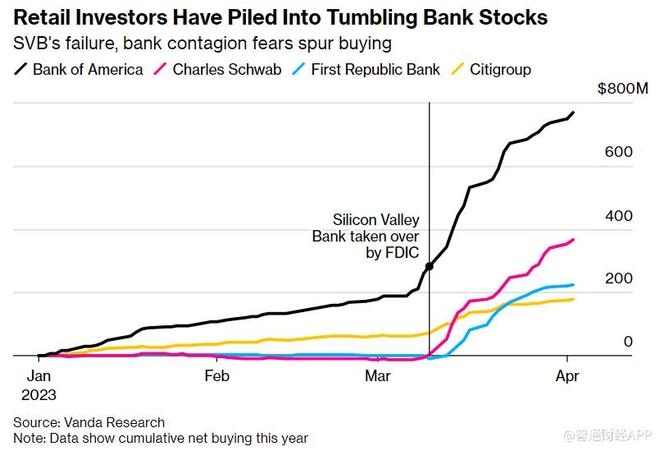

Are you considering investing in US Bank stock? If so, you're not alone. With the financial landscape constantly evolving, many investors are on the lookout for promising investment opportunities. In this article, we delve into the factors you should consider before deciding whether US Bank stock is a buy.

Understanding US Bank

US Bank, officially known as U.S. Bancorp, is one of the largest financial institutions in the United States. The company offers a range of financial services, including retail banking, wealth management, investment banking, and more. With a robust presence across the nation, US Bank has built a reputation for stability and reliability.

Financial Performance

One of the primary factors to consider when evaluating a stock is its financial performance. Over the past few years, US Bank has demonstrated consistent growth in revenue and earnings. The bank's robust financial health can be attributed to several factors:

- Solid Revenue Growth: US Bank has seen steady revenue growth, driven by a diverse portfolio of financial products and services.

- Profitability: The bank has maintained strong profitability, with a return on assets (ROA) and return on equity (ROE) that consistently outperform industry averages.

- Efficient Operations: US Bank's cost management strategies have contributed to its profitability, allowing the company to maintain a competitive edge.

Market Trends and Economic Factors

Investing in a stock is not just about the company's financial performance; it's also about understanding the broader market trends and economic factors that can impact the stock's price.

- Economic Growth: As the U.S. economy continues to grow, financial institutions like US Bank are likely to benefit from increased demand for their services.

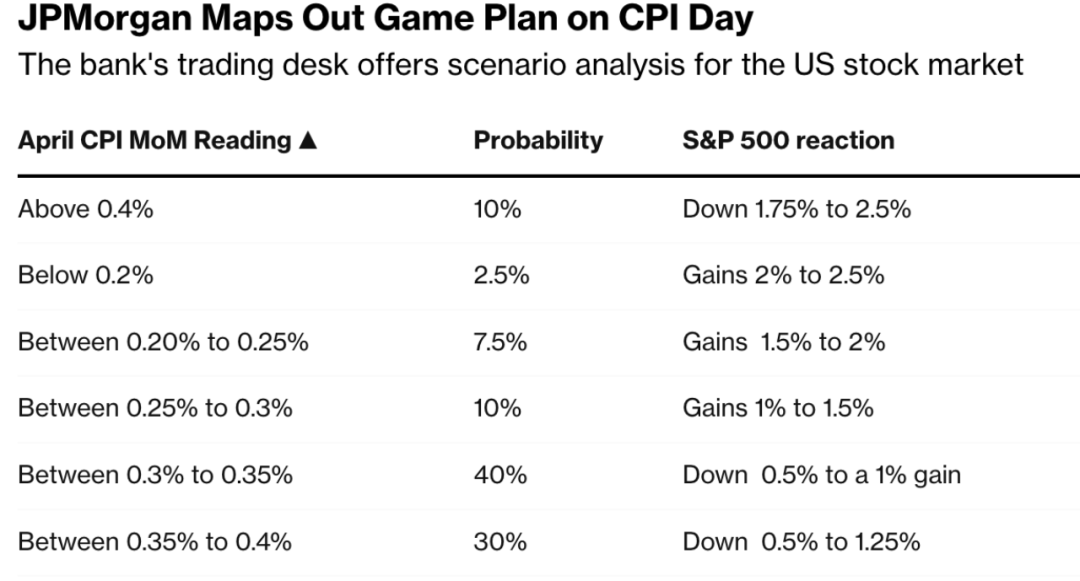

- Interest Rates: Changes in interest rates can significantly impact financial stocks. With the Federal Reserve's current stance on interest rates, US Bank and other financial institutions may see favorable conditions in the near term.

Dividends and Yield

Another crucial aspect to consider is the dividend yield. US Bank has a long history of paying dividends to its shareholders, making it an attractive investment for income-seeking investors.

- Dividend Yield: The bank offers a competitive dividend yield, providing investors with a steady stream of income.

- Dividend Growth: Over the years, US Bank has consistently increased its dividends, reflecting the company's commitment to rewarding its shareholders.

Risk Factors

Like any investment, US Bank stock comes with its own set of risk factors. It's essential to understand these risks before making a decision:

- Regulatory Changes: Changes in financial regulations can impact the profitability of financial institutions.

- Economic Downturns: Economic downturns can lead to a decrease in demand for financial services, impacting the bank's performance.

Conclusion

After considering the financial performance, market trends, economic factors, dividends, and risk factors, the question of whether US Bank stock is a buy depends on your investment strategy and risk tolerance. If you're looking for a stable, well-performing stock with a strong dividend yield, US Bank could be a solid investment choice. However, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Stock Data for US Bank Symbol USB from Yaho? can foreigners buy us stocks