In the ever-evolving world of finance, investors are constantly seeking opportunities to diversify their portfolios. One of the most common questions that arise is whether to invest in international stocks or stick to the traditional US market. This article delves into a comprehensive analysis of both international and US stocks in 2021, highlighting key factors that could influence your investment decisions.

Understanding the International Market

The international stock market encompasses shares of companies based outside of the United States. This market offers a wide range of opportunities, including exposure to different economies, industries, and currencies. In 2021, several factors made the international market an attractive option for investors:

- Diversification: Investing in international stocks can help mitigate risks associated with a single country's economy. For instance, if the US economy faces a downturn, investors can benefit from the growth of companies in other countries.

- Emerging Markets: Many emerging markets, such as China and India, have shown significant growth in recent years. Investing in these markets can provide opportunities for higher returns.

- Currency Fluctuations: The value of the US dollar can fluctuate, affecting the returns on US stocks. Investing in international stocks can help offset these fluctuations.

The US Stock Market in 2021

The US stock market has long been considered a safe haven for investors. In 2021, several factors contributed to its strong performance:

- Economic Recovery: The US economy has shown signs of recovery, with the implementation of various stimulus measures and the rollout of COVID-19 vaccines.

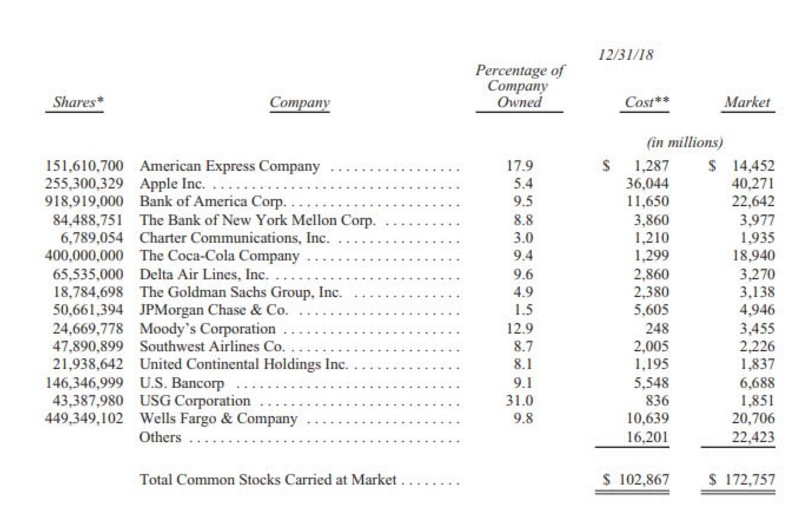

- Technology Sector: The technology sector has played a significant role in driving the US stock market's growth. Companies like Apple, Amazon, and Microsoft have seen substantial increases in their stock prices.

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has made it more attractive for investors to invest in stocks rather than bonds.

Comparing International and US Stocks

When comparing international and US stocks, several factors should be considered:

- Growth Potential: International stocks, particularly those in emerging markets, offer higher growth potential compared to the mature US market.

- Risk: The international market is generally considered riskier than the US market due to political, economic, and currency risks.

- Dividends: The US stock market tends to offer higher dividend yields compared to the international market.

Case Studies

To illustrate the differences between international and US stocks, let's consider two case studies:

- Apple (US Stock): Apple, a leading technology company, has seen significant growth in its stock price over the past few years. Its strong presence in the global market and innovation in technology have contributed to its success.

- Tencent (International Stock): Tencent, a Chinese technology company, has experienced rapid growth in its stock price due to its dominance in the gaming and social media sectors. However, investing in Tencent comes with the risk of political and regulatory challenges in China.

Conclusion

In 2021, both international and US stocks offer unique opportunities for investors. While the US stock market has shown strong performance, the international market offers higher growth potential and diversification. Investors should carefully consider their risk tolerance, investment goals, and market conditions before making a decision.

Top Canibus Stocks for the US Market? can foreigners buy us stocks