Introduction

The US stock market has long been a bellwether for global economic trends. With the recent imposition of tariffs by the Trump administration, investors are closely watching how these changes could impact the market. This article delves into the potential effects of US tariffs on the stock market, analyzing both the short-term and long-term implications.

Understanding Tariffs

To grasp the impact of tariffs on the stock market, it's essential to understand what tariffs are. Tariffs are taxes imposed on imported goods, designed to protect domestic industries and increase revenue for the government. While tariffs can be beneficial for certain sectors, they can also have adverse effects on the broader economy and, consequently, the stock market.

Short-Term Impact

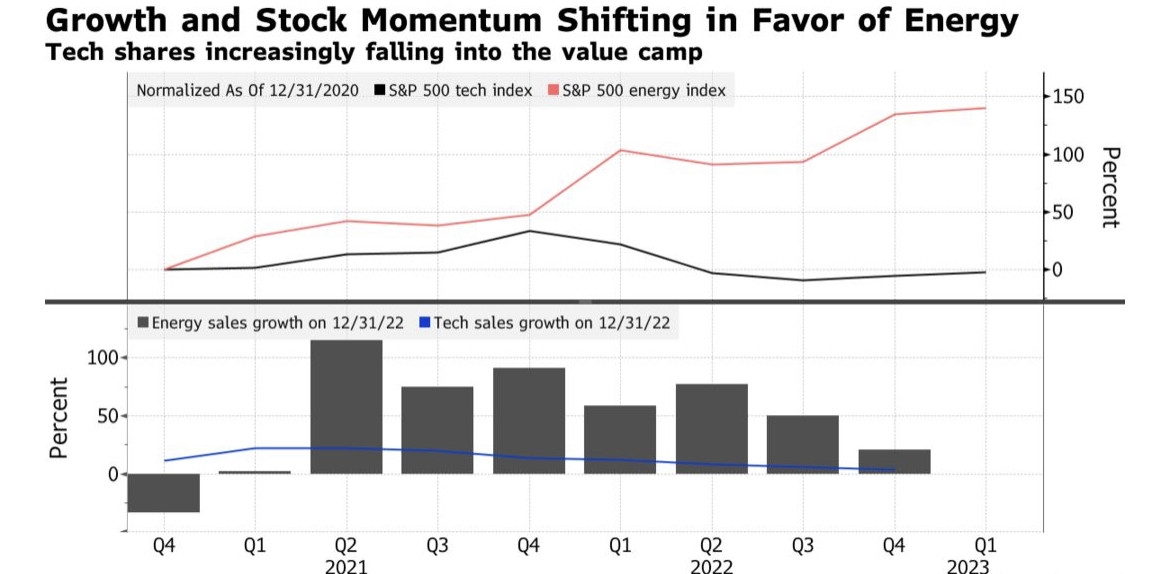

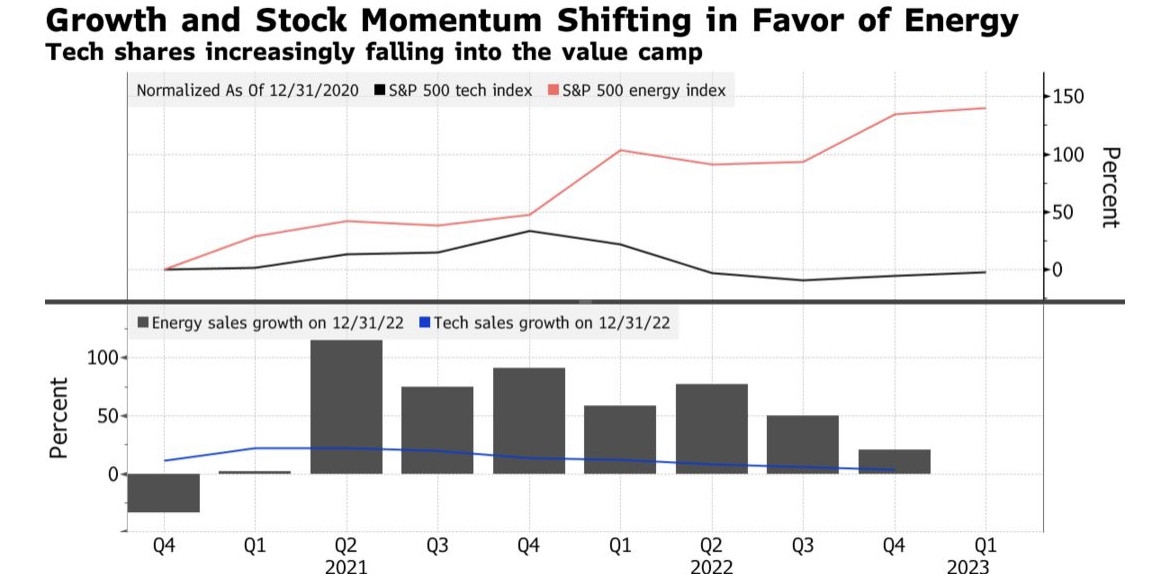

In the short term, the imposition of tariffs can lead to volatility in the stock market. When tariffs are announced, companies that rely heavily on imported goods may experience increased costs, which can lead to a decline in their stock prices. For instance, companies in the technology, automotive, and consumer goods sectors have been particularly affected by the tariffs on Chinese imports.

Long-Term Impact

While the short-term impact of tariffs can be negative, the long-term implications are less clear-cut. Some analysts argue that tariffs could lead to increased investment in domestic industries, boosting the stock market over time. Others contend that tariffs could lead to retaliatory measures by other countries, potentially triggering a global trade war that would have severe consequences for the stock market.

Case Study: Tech Sector

The technology sector has been particularly affected by the tariffs on Chinese imports. Companies like Apple and Microsoft, which rely heavily on components manufactured in China, have seen their stock prices fluctuate significantly. While some investors are concerned about the potential long-term impact of these tariffs, others believe that the tech sector will ultimately adapt and thrive.

Impact on Small Cap Stocks

Tariffs can also have a significant impact on small cap stocks. These companies often rely on international trade and may not have the financial resources to absorb increased costs. As a result, investors in small cap stocks may experience more volatility due to the impact of tariffs.

Conclusion

The impact of US tariffs on the stock market is complex and multifaceted. While the short-term effects can be negative, the long-term implications are less clear. As investors navigate this evolving landscape, it's crucial to stay informed and remain vigilant about the potential risks and opportunities associated with tariffs.

Questrade Commission US Stock: A Comprehens? can foreigners buy us stocks