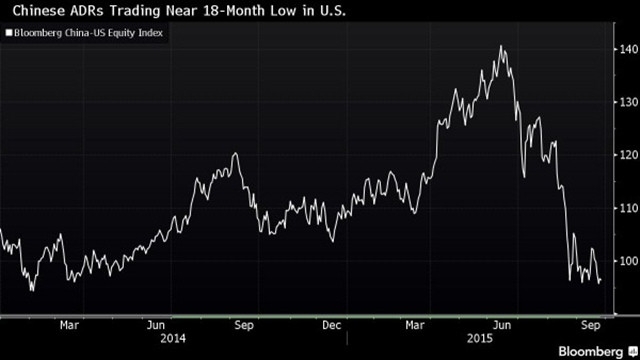

Are you an investor in Europe looking to expand your portfolio to include U.S. stocks? If so, you're not alone. The U.S. stock market is one of the largest and most dynamic in the world, offering a wide range of investment opportunities. In this article, we'll guide you through the process of buying stocks in the U.S. from Europe, step by step.

Understanding the Basics

Before diving into the process, it's important to understand the basics of the U.S. stock market. The U.S. stock market is made up of two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list shares of publicly traded companies, which can be bought and sold by investors.

Choosing a Broker

The first step in buying U.S. stocks from Europe is to choose a broker. A broker is a financial intermediary that facilitates the buying and selling of stocks. There are several types of brokers to choose from, including full-service brokers, discount brokers, and online brokers.

- Full-service brokers offer personalized advice and a range of investment services, but they typically charge higher fees.

- Discount brokers provide lower fees and fewer services, making them a popular choice for self-directed investors.

- Online brokers offer a combination of low fees and a range of investment tools, making them a convenient option for investors looking to buy U.S. stocks from Europe.

Opening an Account

Once you've chosen a broker, you'll need to open an account. This process typically involves filling out an application, providing personal and financial information, and verifying your identity. Some brokers may also require you to wire funds to your account to purchase stocks.

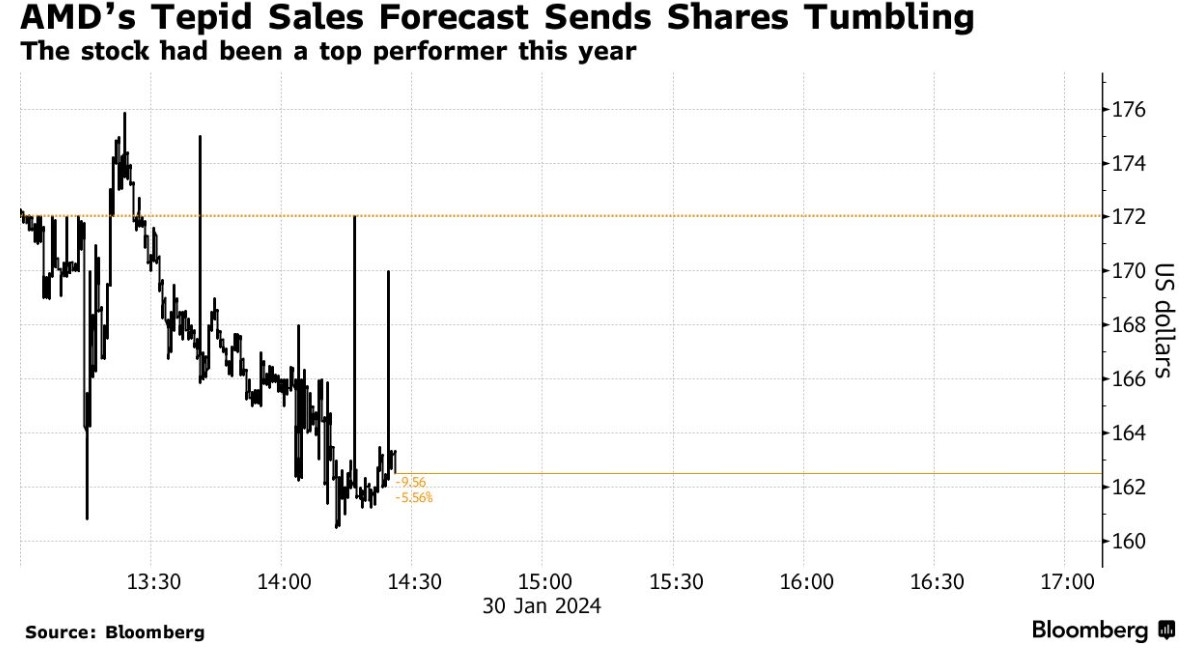

Understanding the Risks

It's important to understand the risks associated with investing in U.S. stocks from Europe. The U.S. stock market can be volatile, and currency fluctuations can impact the value of your investments. Additionally, there may be tax implications to consider.

The Process of Buying Stocks

Once your account is open and funded, you can start buying stocks. Here's a step-by-step guide:

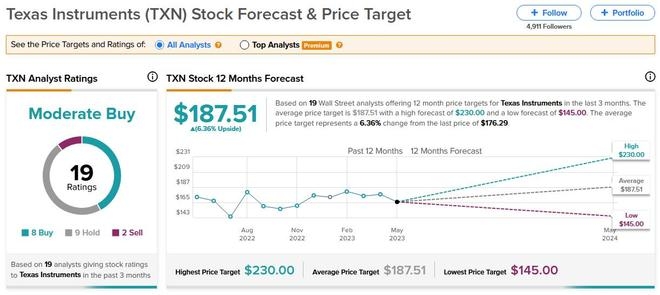

- Research: Before buying any stock, it's important to research the company and its financials. This includes reviewing the company's financial statements, earnings reports, and news releases.

- Choose a Stock: Once you've done your research, choose the stock you want to buy. You can do this by searching for the stock symbol on your broker's platform.

- Enter a Trade: Enter the trade by specifying the number of shares you want to buy and the price you're willing to pay.

- Review and Confirm: Review the trade details, including the price and number of shares, and confirm the trade.

Case Study: Investing in Apple from Europe

Let's say you want to buy shares of Apple (AAPL) from Europe. Here's how you would do it:

- Choose a broker that offers access to U.S. stocks, such as TD Ameritrade or E*TRADE.

- Open an account and fund it with your chosen currency.

- Research Apple's financials and market position.

- Enter a trade to buy shares of Apple at the current market price.

Conclusion

Buying stocks in the U.S. from Europe is a straightforward process, but it requires careful planning and research. By choosing the right broker, understanding the risks, and conducting thorough research, you can successfully invest in U.S. stocks from Europe.

US Furniture Stocks: A Comprehensive Guide ? can foreigners buy us stocks