Introduction

In today's interconnected world, investors from around the globe are looking for new opportunities to diversify their portfolios. One of the most popular destinations for international investors is the United States, with its robust and liquid stock market. But what about investors from Russia? Can they invest in the US stock market? This article delves into the ins and outs of investing for Russians in the US stock market, covering everything from regulations to strategies.

Understanding the Rules

First and foremost, it's essential to understand the regulations governing foreign investment in the US stock market. According to the US Securities and Exchange Commission (SEC), any foreign investor must comply with the Foreign Account Tax Compliance Act (FATCA) and the Bank Secrecy Act (BSA). These regulations require foreign investors to disclose their financial information to the IRS and report certain transactions.

To open an account in the US stock market, Russian investors need to work with a brokerage firm that complies with these regulations. Some of the popular brokerage firms that cater to international investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Choosing the Right Stocks

Once the regulatory hurdles are cleared, the next step is to choose the right stocks. While there are no restrictions on which stocks Russians can buy, it's important to conduct thorough research before making any investment decisions. Here are a few factors to consider:

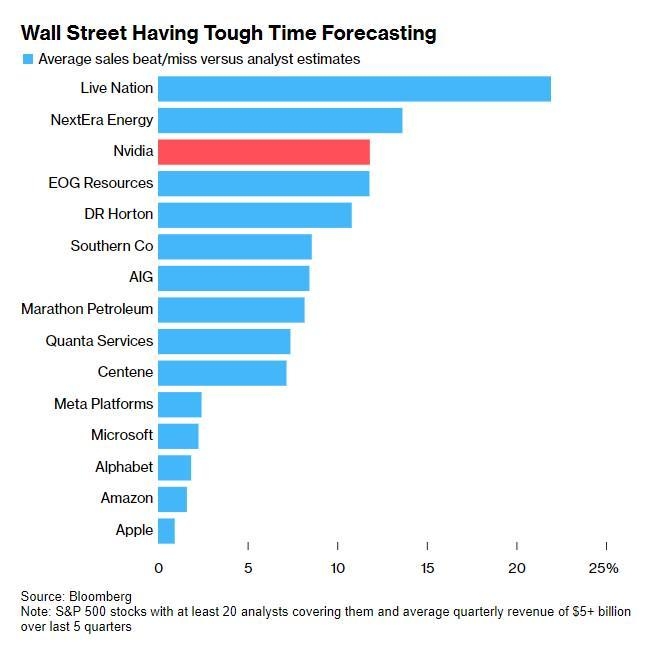

- Market Capitalization: Large-cap stocks tend to be more stable and less volatile than small-cap stocks. For risk-averse investors, large-cap companies like Apple, Microsoft, and Johnson & Johnson are good options.

- Sector: Different sectors perform differently depending on the economic environment. For instance, technology stocks may outperform during periods of technological innovation, while energy stocks may benefit from high oil prices.

- Dividends: Dividend-paying stocks can provide a steady income stream for investors. Companies like Procter & Gamble and Coca-Cola are known for their reliable dividends.

Diversification and Risk Management

Diversification is key to managing risk in any investment portfolio. By spreading investments across different sectors, geographic regions, and asset classes, investors can mitigate the impact of market downturns. For Russian investors, a well-diversified portfolio may include a mix of US stocks, international stocks, bonds, and other asset classes.

Case Study: Investment in Amazon

To illustrate the potential of investing in the US stock market, let's take a look at Amazon. Since its initial public offering (IPO) in 1997, Amazon has become one of the most valuable companies in the world. An investor who bought

This case study demonstrates the power of investing in a successful company and the importance of patience and long-term investing.

Conclusion

In conclusion, Russian investors can certainly invest in the US stock market. By understanding the regulations, conducting thorough research, and diversifying their portfolios, they can take advantage of the opportunities available in one of the world's largest and most dynamic stock markets. However, it's crucial to remember that investing always involves risks, and it's essential to do your due diligence before making any investment decisions.

Micro Cap Stocks Under $300 Million Market ? can foreigners buy us stocks