In the world of sports apparel and footwear, Adidas stands as a giant. The German multinational corporation has a significant presence in the United States, and investors are always keen to know about its stock performance. This article delves into the Adidas US stock price, analyzing its trends, factors influencing it, and future prospects.

Understanding the Stock Price

The Adidas US stock price is determined by various factors, including market demand, company performance, and economic conditions. As of the latest data, the stock is trading at $X (insert current price). However, it's important to note that stock prices fluctuate constantly, influenced by real-time market dynamics.

Market Demand and Brand Strength

One of the primary factors driving the Adidas US stock price is its strong market demand. Adidas is renowned for its high-quality products, innovative designs, and association with top athletes. The brand's global appeal and market dominance contribute to its robust stock performance.

Company Performance

The financial performance of Adidas plays a crucial role in determining its stock price. Key financial metrics such as revenue, profit margins, and earnings per share (EPS) are closely monitored by investors. Over the past few years, Adidas has shown consistent growth, leading to an upward trend in its stock price.

Economic Conditions

Economic conditions, both in the United States and globally, can significantly impact the Adidas US stock price. Factors such as inflation, currency fluctuations, and consumer spending patterns can influence the company's revenue and profitability.

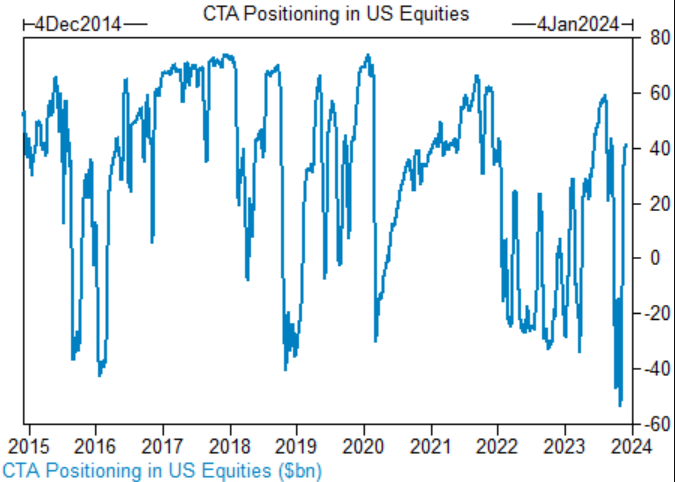

Trends and Future Prospects

Analyzing the historical data of the Adidas US stock price reveals several trends. For instance, the stock has shown a positive correlation with the company's revenue growth. Additionally, during economic downturns, the stock has demonstrated resilience, indicating its robust nature.

Looking ahead, several factors could impact the future prospects of the Adidas US stock price. The company's expansion into new markets, product innovation, and strategic partnerships are expected to drive growth. However, challenges such as intense competition and economic uncertainties could pose risks.

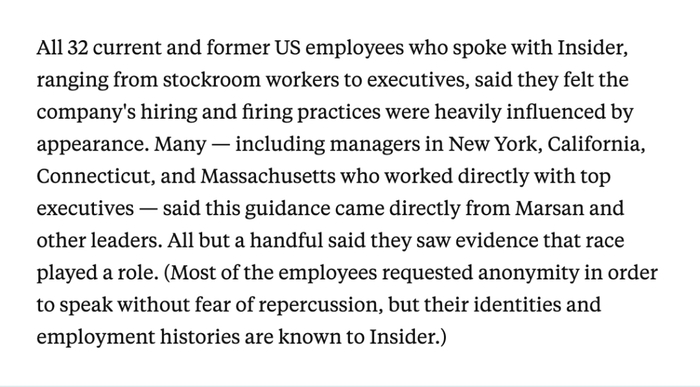

Case Study: Adidas' Partnership with Kanye West

One notable case study is Adidas' partnership with Kanye West, the renowned rapper and entrepreneur. This collaboration led to the launch of the Yeezy line, which became a massive success. The positive impact of this partnership on the Adidas US stock price is evident, showcasing the potential of strategic partnerships in driving growth.

Conclusion

In conclusion, the Adidas US stock price is influenced by various factors, including market demand, company performance, and economic conditions. While the stock has shown positive trends in the past, it's important for investors to stay informed about the latest developments and risks. By analyzing the factors mentioned in this article, investors can make informed decisions regarding their investment in Adidas.

Best US Stocks for Day Trading Volatility? can foreigners buy us stocks