The rise of Airbnb as a global leader in the short-term rental market has been nothing short of remarkable. With its IPO in 2020, investors have been eagerly watching the stock price of this innovative company. In this article, we delve into the factors influencing the Airbnb stock price, its performance since its IPO, and future prospects.

Understanding Airbnb's Stock Price

The stock price of Airbnb (NASDAQ: ABNB) is influenced by a variety of factors, including its financial performance, market conditions, and the company's growth prospects. Financial performance is a key driver of stock price movements. This includes metrics like revenue growth, profit margins, and earnings per share (EPS).

Performance Since IPO

Airbnb went public on December 29, 2020, at an initial offering price of

Several factors have contributed to the volatility in Airbnb's stock price. COVID-19 had a significant impact on the travel industry, and Airbnb's business was not immune. However, the company demonstrated resilience and adaptability, which helped it weather the storm. As travel restrictions began to ease, Airbnb's stock price started to recover.

Influencing Factors

Several key factors influence Airbnb's stock price:

Revenue Growth: Airbnb's revenue has been growing consistently, driven by the increasing demand for short-term rentals. The company has expanded its offerings beyond accommodation to include experiences and restaurants, further boosting its revenue streams.

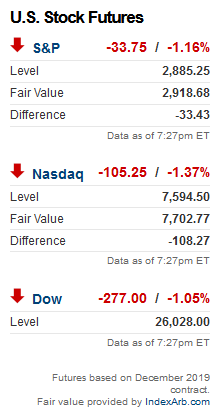

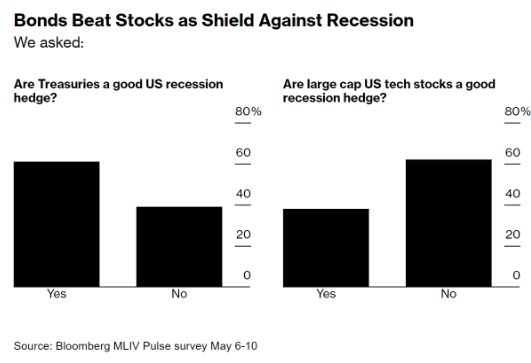

Market Conditions: The stock market's overall performance can have a significant impact on Airbnb's stock price. During periods of market uncertainty, investors may be more cautious, leading to a decline in stock prices.

Economic Factors: Economic conditions, such as inflation and interest rates, can also influence Airbnb's stock price. For instance, higher interest rates can make borrowing more expensive for consumers, potentially reducing travel demand.

Regulatory Changes: Airbnb operates in a highly regulated industry, and changes in regulations can impact its business. For example, cities and countries may impose stricter rules on short-term rentals, which could affect Airbnb's growth prospects.

Future Prospects

Looking ahead, Airbnb's future prospects appear promising. The company continues to innovate and expand its offerings, which should help drive revenue growth. Additionally, the rise of remote work and travel may further increase demand for short-term rentals.

However, there are challenges to consider. Competition from other short-term rental platforms and hotel chains is intensifying. Moreover, regulatory challenges remain, as cities and countries seek to regulate the industry.

Case Study: Airbnb's Response to COVID-19

One notable example of Airbnb's resilience is its response to the COVID-19 pandemic. The company took several measures to support its hosts and guests, including offering flexible cancellation policies and providing financial assistance to affected hosts. These actions helped maintain trust in the brand and contributed to its recovery.

In conclusion, the Airbnb stock price has experienced significant volatility since its IPO. However, the company's strong financial performance, innovative business model, and adaptability to market conditions suggest a promising future. As investors continue to monitor Airbnb's growth prospects, the stock price is likely to remain a topic of interest.

Is the US Stock Market Open? Understanding ? us stock market today live cha