The passing of the "Big Beautiful Bill" has sent shockwaves through the US stock market, sparking debates and analyses across financial platforms. This comprehensive piece delves into the impact of this landmark legislation on the stock market, providing an in-depth analysis of its effects on various sectors and investors.

Understanding the Big Beautiful Bill

The Big Beautiful Bill, a sprawling piece of legislation, encompasses a range of initiatives aimed at boosting the US economy. From infrastructure spending to tax cuts, this bill is a testament to the government's commitment to economic growth. However, its impact on the stock market is a subject of intense scrutiny.

Stock Market Impact: A Closer Look

1. Infrastructure Spending

One of the key components of the Big Beautiful Bill is the massive infrastructure spending. This initiative is expected to create jobs and stimulate economic growth. As a result, sectors like construction and manufacturing have seen a surge in optimism, leading to increased stock prices.

Case Study: Construction Sector

The construction sector has been a significant beneficiary of the Big Beautiful Bill. Companies like Caterpillar (CAT) and United Rentals (URI) have seen their stock prices soar, driven by increased demand for construction equipment and services.

2. Tax Cuts

The Big Beautiful Bill also includes substantial tax cuts for corporations and individuals. While the long-term impact of these cuts is still uncertain, they have already led to a rise in stock prices, particularly in sectors like technology and finance.

Case Study: Technology Sector

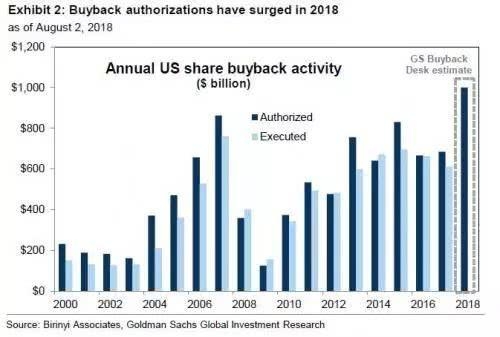

Tech giants like Apple (AAPL) and Microsoft (MSFT) have seen their stock prices surge following the tax cuts. These companies are expected to benefit from increased after-tax profits, leading to higher dividends and share buybacks.

3. Consumer Spending

The tax cuts are also expected to boost consumer spending, which in turn can drive economic growth and benefit the stock market. Companies in consumer discretionary sectors like retail and consumer goods have seen a positive impact.

Case Study: Retail Sector

Retail companies like Walmart (WMT) and Target (TGT) have seen increased optimism following the tax cuts. Consumers are expected to spend more, leading to higher sales and potentially higher stock prices.

4. Foreign Investment

The Big Beautiful Bill has also attracted foreign investment, driven by the optimism surrounding the economic growth initiatives. This influx of capital has further bolstered the stock market.

Conclusion

The Big Beautiful Bill has had a significant impact on the US stock market, with various sectors benefiting from its provisions. While the long-term effects are still uncertain, investors and analysts are closely monitoring the developments to understand the full implications of this landmark legislation.

Title: Understanding the PE Ratio: A Key In? us stock market today