In the ever-evolving world of finance, it's crucial to stay ahead of the curve. One of the latest moves that has caught the attention of investors is the upgrade of US stocks by Citigroup. This article delves into what this upgrade means for the market and how it could impact your investment decisions.

Understanding the Citigroup Upgrade

Citi, one of the world's leading financial institutions, has recently upgraded its outlook on US stocks. This upgrade is a significant development as it comes from a firm that is known for its thorough analysis and conservative approach to market forecasting. The upgrade suggests that Citigroup believes the US stock market is poised for growth in the near future.

Factors Behind the Upgrade

Several key factors have contributed to Citigroup's decision to upgrade US stocks. These include:

- Strong Economic Indicators: The US economy has shown resilience, with low unemployment rates and strong consumer spending. These positive economic indicators suggest a robust market for stocks.

- Corporate Earnings: Companies in the US have been reporting strong earnings, which is a positive sign for the overall market.

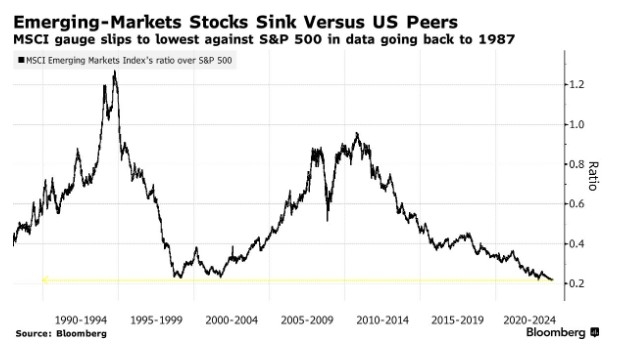

- Global Economic Conditions: While there are uncertainties in the global economy, the US market has shown its ability to remain relatively insulated from these external factors.

Impact on Investors

The Citigroup upgrade is a strong signal for investors to reconsider their portfolios. Here's how it could impact your investment decisions:

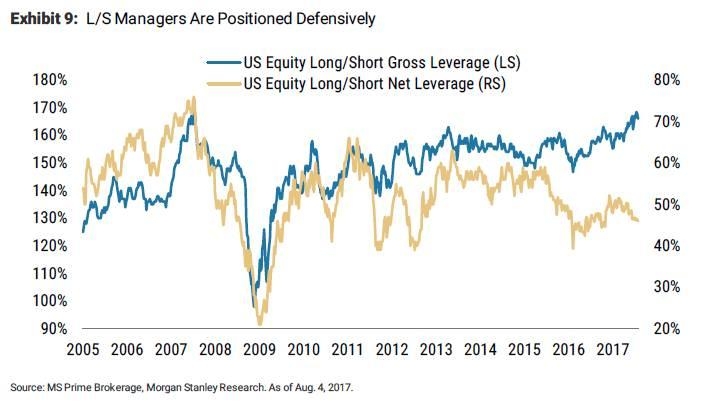

- Increased Confidence: The upgrade from Citigroup is likely to boost investor confidence, leading to increased buying activity in the stock market.

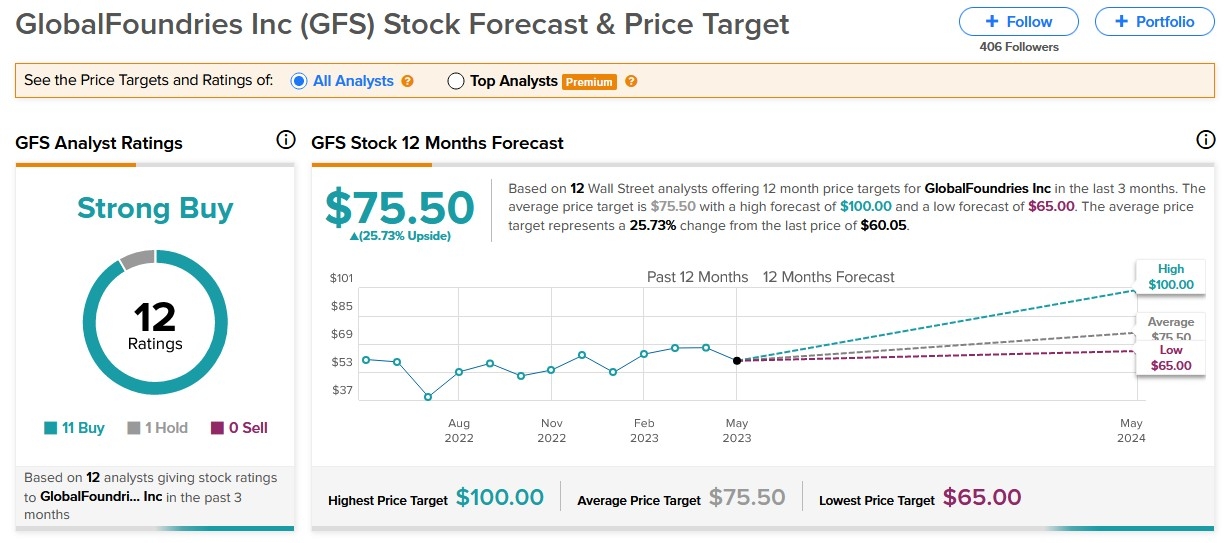

- Sector Rotation: Investors may consider reallocating their portfolios to sectors that are expected to benefit from the upgrade, such as technology, financials, and healthcare.

- Long-Term Investing: The upgrade suggests a positive outlook for the long term, making it an opportune time to consider long-term investments.

Case Studies

To put the Citigroup upgrade into perspective, let's look at a few case studies:

- Technology Sector: The upgrade could benefit technology stocks, which have been a major driver of the US stock market's growth over the past few years.

- Financials: The financial sector, which includes banks and insurance companies, could also see positive gains due to the upgrade.

- Healthcare: With the aging population and advancements in medical technology, the healthcare sector is expected to remain a strong performer.

Conclusion

In conclusion, the upgrade of US stocks by Citigroup is a significant development that investors should take note of. With a strong economic outlook and positive corporate earnings, the US stock market appears to be in a favorable position. As always, it's important to conduct thorough research and consider your own investment goals before making any decisions.

Is the US Stock Market Open? Understanding ? can foreigners buy us stocks